Web big Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) can be reporting its second quarter monetary numbers on July 25. Wall Avenue analysts stay upbeat about Alphabet inventory forward of the Q2 print and anticipate the corporate to ship better-than-expected quarterly numbers as a result of power in Search and momentum within the Cloud enterprise.

Q2 Expectations for GOOGL

Analysts anticipate GOOGL to report income of $72.84 billion in Q2, reflecting an enchancment on a year-over-year and sequential foundation. The corporate delivered income of $69.79 billion in Q1 of 2023 and $69.69 billion within the second quarter of 2022.

The development in its prime line will come from larger Google Search & different revenues. Additional, the momentum in Google Cloud revenues will assist its top-line development. Notably, cloud revenues elevated by 28% in Q1.

Because of the upper revenues, analysts challenge GOOGL’s earnings to extend on a year-over-year and sequential foundation. Wall Avenue expects Alphabet to report earnings of $1.34 a share, in comparison with an EPS of $1.21 within the prior-year quarter. This compares favorably to the earnings of $1.17 per share in Q1 of 2023.

Analysts Carry GOOGL’s Value Goal Forward of Earnings

A number of analysts raised Google inventory’s worth goal forward of the Q2 earnings. On July 21, Stifel Nicolaus analyst Mark Kelley elevated Alphabet’s worth goal to $135 from $130. Kelley is bullish about GOOGL inventory. The analyst sees a slight enchancment in digital promoting tendencies, which can profit Alphabet.

Previous to Kelley, Financial institution of America Securities analyst Justin Submit raised GOOGL inventory’s worth goal to $142 from $128 on July 19. Submit expects Alphabet to profit from steady search share tendencies.

Additional, Jefferies analyst Brent Thill expects the corporate to exceed analysts’ consensus estimates for Q2. In a word to buyers dated July 18, Thill mentioned that his checks recommend larger advert spend development within the second quarter. Thill added that Alphabet’s valuation is “low” and expects an improved advert spending surroundings within the second half of 2023. Thill has a worth goal of $150 on GOOGL inventory.

Justin Patterson of KeyBanc expects a reacceleration in income development in Q2 and sees Avenue’s earnings forecast as conservative. The analyst raised Alphabet’s worth goal to $140 from $122 on July 18. Furthermore, the analyst maintained a bullish outlook on Alphabet inventory forward of Q2 earnings.

The AI Alternative

Analysts view Alphabet because the main participant in the AI (Synthetic Intelligence) house. Alphabet has made appreciable investments in AI, which can open up vital development alternatives in search, adverts, and different companies.

Tigress Monetary analyst Ivan Feinseth reiterated a Purchase advice on GOOGL inventory on July 14. Feinseth believes that “the growing integration of AI performance will proceed to drive its management place throughout all key expertise tendencies and enterprise traces.”

His worth goal of $172 implies a stellar 43.31% upside potential in GOOGL inventory from present ranges.

Is Alphabet Inventory a Purchase Now?

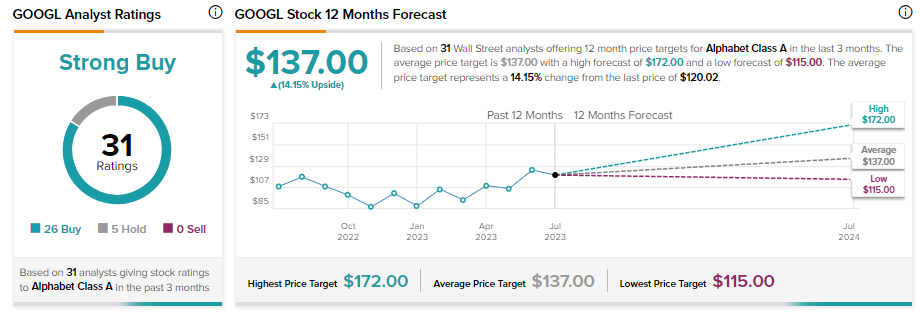

Alphabet is well-positioned to capitalize on the restoration in advert spending. In the meantime, its AI developments and power within the cloud enterprise bode properly for future development. Alphabet inventory sports activities a Sturdy Purchase consensus ranking forward of Q2 earnings, reflecting 26 Purchase and 5 Maintain suggestions.

Whereas GOOGL inventory has appreciated quite a bit, analysts’ common worth goal of $137 per share implies 14.15% upside potential from present ranges.

Disclosure